31st October Tax Return Deadline

Yes it is that time of the year…again…so let’s get down to business

If your sending a paper tax return it must reach the HMRC by midnight 31st October. Although this applies only to the submission of paper tax returns to the HRMC, there are a number of advantages of completing the personal tax return now rather than waiting for the final tax deadline in Jan 2014 and risking unnecessary penalties.

Firstly you will know exactly what your tax position is in advance – the final January deadline is also the tax payment deadline, so if the return is left until then you may suddenly find that you have a tax bill to pay that you hadn’t planned for.

Secondly Return processing times are usually quicker at this time of year, so submitting the return now will mean that the position can be agreed in advance of the statements of account being issued at the end of the year.

Thirdly you may be able to have tax liabilities collected in future years by instalments through your notice of coding. You do need however to have suitable employment or pension earnings, and the tax liability should be below £3,000 for this to be an option. Before the 31st October HMRC guarantee to collect the tax this way, however after the end of the month there is an increasing chance that this will not be an option.

Also keep in mind that should you miss the tax return deadline, the longer you delay submitting the forms the more you will have to pay and if you don’t send your return by the deadline, HRMC may estimate the tax you owe. You can only change this estimate by yes you guessed it…sending your tax return. (You will however have to pay any penalties due for missing the tax return deadline and interest on any tax you pay late)

If you submit a paper tax return on or after the 1st November you will be hit with a £100 penalty – even if there is no tax to pay or the tax due is paid on time…..This can all be avoided by submitting your tax return online which brings with it many advantages

· If you submit your tax return online you get an extra three months to submit it

· Your tax is calculated automatically

· You will receive an immediate online acknowledgement

· Your tax return is processed faster, so any money your owed is repaid more quickly

However remember if you do send a paper return after the 31 October deadline, You cannot avoid the initial £100 penalty by subsequently filing online.

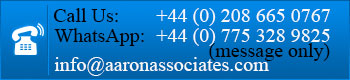

Finally if you’re not entirely sure of your situation and whether you should be even submitting a form, feel free to contact us for some friendly advice.